AXA KOREA Car Insurance

- Your visit to this site may be recorded for analysis on the number of visitors to the site and general usage patterns which will be gathered through the use of "Cookies". Cookies are small text files, created by the website visited, that contain data. They are stored on the visitor’s computer to give the user access to various functions. We use cookies to learn more about the way visitors interact with our content and help us to improve the experience when visiting our website.

- You can choose to reject or block the cookies set by AXA Korea by changing your browser settings as follows: - The Cookies setting (ex. Internet Explorer) : Menu on Browser > Internet Options > Personal Information Note, however, that if you reject the use of cookies you will still be able to visit our websites but some of the functions may not work correctly.

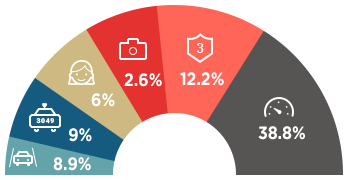

- Get 38.8% discount for

low-mileage car insurance. (Drive distance under 2,000km/ post-discount for private cars)

- Get 12.2% off, if you are accident-free for

the recent 3 years. (Inception date : 6th June, 2023)

- Get extra 2.6% special clause discount if you have a black box.

- Get 6% off for My kid's special clause(Under 7 year old : 6%, 8~12 year old : 3%, 13~15 year old : 2%)

- Get average 9% off, if you are 30~49 years old

- Get 8.9% for having safety device in your car(Autonomous Emergency Braking System/Lane Departure Warning System)

We may drive the same car, but everyone’s life is different.

Thus, if we are living different lives, each one of us needs different car insurance.

We proudly introduce you AXA Direct Car Insurance customized to the driver’s life, not to the car.

Discover car insurance that best fits your stage in life!

* Click on the image to view the detail.

first car is only fleeting!

Are you a fist-time driver

worried about accidents?

Providing the essential coverage you need for

your precious first car at a reasonable price

- What if my precious first car is seriously damaged

in an accident? - This product will provide the money you need to buy a new car (sum insured), not simply the repair costs (if you purchase the special clause.)

- * Only within 12 months after the initial car registration and only when the cost of repairing the insured car damaged in an accident exceeds 60% of the sum insured

number one priority

in an accident?

Providing essential coverage to protect your family at a reasonable price.

- For my family’s peace of mind!

- When an accident happens, AXA Direct provides consolation money for the injury as well as cosmetic surgery for children and support for serious disabilities. In the tragic event of the insured’s death, AXA Direct will support the insured’s children’s education expenses. (Note that education expenses will only be paid for children 19 years of age or younger, and you must purchase the special clause.)

- AXA Direct will provide the money to buy a new car (sum insured), not simply the repair costs. (Note that to receive the sum insured, you must purchase the special clause.)

- * Only within 12 months after the initial car registration and only when the cost of repairing the insured car damaged in an accident exceeds 60% of the sum insured

covered in all situations?

Providing essential coverage for people

looking for more comprehensive coverage at a reasonable price

- Your worries are gone when you choose

multiple-coverage! - AXA Direct will provide the money to buy a new car (sum insured), not simply the repair costs. (Note that to receive the sum insured, you must purchase the special clause.)

* Only within 6 months after the initial car registration and only when the cost of repairing the insured car damaged in an accident exceeds 70% of the sum insured - You’re even covered if you die while riding a bus (if you subscribe to the special clause).

driver who has never been

in a car accident?

Providing essential coverage for new drivers

at a reasonable price

your children several times a day?

Providing essential coverage for the safety

of your children at a reasonable price

- Keep your children protected at all times!

- AXA Direct provides consolation money for the injury as well as cosmetic surgery for children and support for serious disabilities. In the tragic event of the insured’s death, AXA Direct will support the insured’s children’s education expenses. (Note that education expenses will only be paid for children 19 years of age or younger, and you must subscribe to the special clause.)

handle accidents?

Essential yet reasonably priced coverage for people who value their time

- AXA Direct will provide the money to buy a new car (sum insured), not simply the repair costs. (Note that to receive the sum insured, you must purchase the special clause.)

* Only within 12 months after the initial car registration and only when the cost of repairing the insured car damaged in an accident exceeds 60% of the sum insured

cut down on costs?

A policy for people looking for reasonable coverage at a reasonable price

- Focusing only on essential coverage!

- Coverage includes Bodily Injury Liability Ⅰ Coverage, Bodily Injury Liability II Coverage (unlimited), Property Damage Liability Coverage (KRW 100 million), Own Bodily Injury I Coverage (KRW 30 million), Uninsured Car Coverage, and Emergency Service.

when there is a child

in the car!

Essential yet reasonably priced coverage for people

like you who are concerned about a child in the car

- For the safety of your children!

- AXA Direct provides consolation money for the injury as well as cosmetic surgery for children and support for serious disabilities. In the tragic event of the insured’s death, AXA Direct will support the insured’s children’s education expenses. (Note that education expenses will only be paid for children 19 years of age or younger, and you must subscribe to the special clause.)

before, there is nothing

you can do in a public

transportation accident!

Essential yet reasonably priced coverage for people

like you who want to be covered in the event of a

public transportation accident

- You’ll be covered even when you’re not in your car!

- You’ll be covered even if you die while riding a bus (if you subscribe to the special clause.)

- If a person is killed or injured as the result of an accident caused by an insured car identified in an insurance policy while the insured owns, uses, and manages the insured car, compensation will be made within the limit stipulated by the Act on Guarantee of Compensation for Loss Caused by Automobile.

Bodily Injury Liability Coverage I (Compulsory Insurance) Category Accidents before 3/31/2016 Accidents after 4/1/2016 death/disability KRW 100 million KRW 150 million injury KRW 20 million KRW 30 million

- If a person is killed or injured as the result of an accident caused by an insured car identified in an insurance policy while the insured owns, uses, and manages the insured car, compensation will be made for the loss that exceeds the amount covered by ‘Bodily Injury Liability I Coverage’ within the sum insured mentioned in the insurance policy.

- Sum insured: You can choose from the following: KRW 50 million, 100 million, 200 million, 300 million or unlimited per victim.

- If an accident involving an insured car identified in an insurance policy causes the loss of or damage to another person’s property while the insured owns, uses, and manages the insured car, compensation will be made within the sum insured mentioned in the insurance policy.

보험 가입 예시표 Category Sum insured Accidents before 3/31/2016 You can choose from the following: KRW 10 million(Obligation), 20 million, 30 million, 50 million, 100 million, 200 million, 300 million,

or 500 million per accident.Accidents after 4/1/2016 You can choose from the following: KRW 20 million(Obligation), 30 million,

50 million, 100 million, 200 million, 300 million,

or 500 million per accident.

- If an accident involving an insured car identified in an insurance policy causes the death of or injury to the insured while the insured owns, uses, and manages the insured car, compensation will be made.

Own Bodily Injury Coverage I (Own Bodily Injury Coverage II) Own Bodily Injury I Coverage Own Bodily Injury II Coverage

(stronger coverage)Sum insured

against deathSum insured

against injurySum insured

against deathSum insured

against injuryChoose one of the following:

Up to KRW 15 million

Up to KRW 30 million

Up to KRW 50 million

Up to KRW 100 millionChoose one of the following:

Up to KRW 15 million

Up to KRW 30 million

Up to KRW 50 millionChoose one of the following:

Up to KRW 100 million

Up to KRW 200 millionChoose one of the following:

Up to KRW 10 million

Up to KRW 20 million

Up to KRW 30 million

Up to KRW 50 million - If you subscribe to 'Own Bodily Injury Ⅰ Coverage', compensation will be made for disability within the limits set by the injury grade or disability grade.

- Compensation will be made if the insured is killed or injured by an uninsured car or a hit-and-run car.

- Compensation will be made for the actual damage of up to KRW 200 million for each insured individual. (up to KRW 500 million if you subscribe to special clause for additional coverage against injury by an uninsured car)

- Compensation will be made for the damage directly caused to an insured car identified in an insurance policy due to an accident while the insured owns, uses, and manages the insured car.

- Compensation will be made within the sum insured mentioned in the insurance policy.

- In case you subscribe to the “Car-to-Car Crash and Theft Coverage”, the loss caused by the crash and theft is covered only if the owner or driver of the other vehicle is identified.

- Deductible: 20 or 30% of the loss amount caused by the accident of the insured car will be deducted. The maximum deductible is KRW 500,000, and the minimum is the amount equivalent to 10% of the property damage threshold for premium surcharge identified in the insurance policy.

- E.g., If the property damage threshold for premium surcharge is KRW 2 million, the minimum deductible will be KRW 200,000, and the maximum deductible will be KRW 500,000.

Own Car Damage Coverage Car damage If the deduction rate is 20% If the deduction rate is 30% Deduction rate calculated amount Insured deductible Deduction rate calculated amount Insured deductible KRW 500,000 KRW 100,000 As it is smaller than the minimum,

KRW 200,000KRW 150,000 As it is smaller than the minimum,

KRW 200,000KRW 1.5 million KRW 300,000 As it is greater than the minimum and smaller than the maximum,

KRW 300,000KRW 450,000 As it is greater than the minimum and smaller than the maximum,

KRW 450,000KRW 3 million KRW 600,000 As it is greater than the maximum,

KRW 500,000KRW 900,000 As it is greater than the maximum,

KRW 500,000

currently available products

-

Have a safe trip with Temporary Driver Special Clause!

AXA Direct will cover accidents occurring while a temporary driver was driving regardless ‘Driver’s Age Special Clause’ or ‘Driver’s Range Special Clause’. -

Period

Up to 30 days during the insurance period of policy -

Driver

Anyone who has the legitimate driver license ※ When “Temporary Driver Special Clause” period ends, your driver’s age and range will automatically return to the previous ones.

※ You can choose the effective date from tomorrow. Please make the change one day before the starting date.

-

Named Insured Only (limited to 1 person)

Only the insured may drive the car. This results in the lowest possible premium. -

Married Couple Only (limited to a designated couple)

Only the insured and the insured’s spouse may drive the car. Common law marriages are eligible. -

Family Only (siblings excluded)

Both the insured and the immediate family may drive the car. The insured’s spouse, parents, the spouse’s parents, adoptive parents, step parents, adopted children, step children, sons-in-law and daughters-in-law are included, but the insured’s siblings are not included. -

Family Only (siblings included)

All family members and the insured’s siblings may drive the car.

(However, the insured’s spouse’s siblings are excluded) -

One Plus One (the insured + one other person)

The insured and one other person designated by the insured may drive the car. The insured’s spouse is excluded. ※ If drivers that do not fall within the selected range and age are involved in a car accident, only Bodily Injury Liability I Coverage (compulsory insurance) will apply. Please keep this in mind when you subscribe.

-

You can save on your premiums by limiting the age of eligible drivers.

The age of the persons who will drive the car, including the named insured, can be limited to a set minimum age. As the specified age increases, the premium decreases. The specified age refers to the age according to the birth date on the resident registration card as of the accident date. If an accident occurs while someone under the specified age is driving the car, it will not be covered. (E.g., If the minimum age is set at 26, accidents will be covered only if the driver’s age is 26 or older at the time of the accident)

-

Feel reassured when you have to use a proxy driver service!

AXA Direct will cover you against accidents occurring while a proxy driver was driving. If an accident occurs while the insured was riding in his/her insured car being driven by a proxy driver, this special clause will cover the insured. In this case, the Driver's Age Special Clause and Driver's Range Special Clause do not apply.

-

Have you ever left the headlights on all night, and the car wouldn’t start the next morning? You’ve probably experienced this once or twice.

However, depending on the length of insurance period, different service limits apply. If the insured uses all services to the limit, this special clause will automatically be terminated, and the service will be provided on a charged basis after the termination.※ Number of service requests you may make

If your policy’s inception date is before November 4, 2015 Insurance period Less than 1 year 1 year Number of service requests you may make 3 5 If your policy’s inception date is November 5, 2015 and thereafter Insurance period Less than 2 months 2-4 months 5-7 months 8-9 months 10 months or longer Number of service requests you may make 1 2 3 4 5 -

24-hour emergency road services

If you call 02-3479-3030(no area code needed) from anywhere in the country at any time and ask for emergency road services, AXA Direct will quickly arrive on the scene. -

GPS location tracking service

Our emergency road service staff will be dispatched after confirming your location through your mobile phone.

Emergency towing / emergency fueling / battery charging / tire replacement / unlocking / emergency rescue

-

If the insured is criminally liable because he/she killed or seriously injured others while driving the insured car, AXA Direct will cover the settlement for criminal cases.

If the driver caused a fatality: KRW 30 million

If the driver caused class 1 through 7 injuries and/or other serious injuries: KRW 3 million to 15 million

Please feel free to Submit a free consultation on the main page.